Stock Market Crash 2008 - 2009 - 2010 -

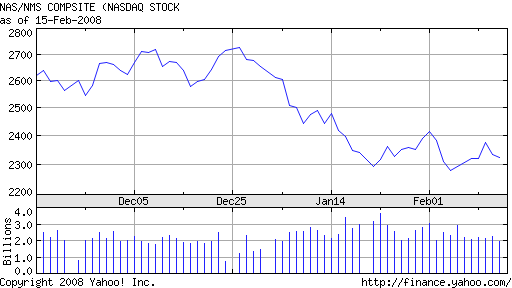

Nasdaq Crash, Next Wave Down Coming

Stock Market crash of 2008 / 2009 leading investors to Gold

Stock Market crash worries are leading investors to interesting places to keep their money. Since before the 2008 stock market crash, gold has been exploding. We also find that money has been flowing in to both India and China since the collapse of the US Stock Market. For information on places other than the crashing US Stock Market, visit our research on Gold and the Indian Rupee.

New news and no stop to the Stock Market Crash of 2009. Did we think the market would stop crashing as 2008 came to an end? Be sure that 2009 may be worse for the market than 2008. Is that possible?

You better believe it. The Stock Market Crash 2009 is very real.

One of the most underestimated events in modern financial history is about to happen. With no rate cut today from the Federal Reserve. AIG will fail, this will cause the biggest leg-down yet in the current 2008 Stock Market Crash.

Equity CrowdFunding Website Reviews

The Federal Reserve, meeting during an unprecedented crisis on Wall Street, decided to leave interest rates unchanged but expressed concern about the crisis escalating.

The Fed's action to keep rates at 2% was a disappointment to investors, who were hoping that recent turmoil in financial markets would prompt the central bank to resume cutting interest rates. The Fed's action to keep rates at 2% was a disappointment to investors, who were hoping that recent turmoil in financial markets would prompt the central bank to resume cutting interest rates. In its statement, the Fed said "strains in financial markets have increased significantly and labor markets have weakened further." However, the central bank said it also remained concerned about inflation pressures......No mention of the eminant failure of AIG, which will affect financial institutions around the world. This is sure to cause the Global Stock Market Crash of 2008

Bank Failures, continued bad news....No end in site to the market crash of 2008

Notice that each holiday brings us closer to the Great Stock Market Crash of 2008. It's been a very strange year in the stock market. Look back at the 2008 calendar as the stock market crashes, month after month.

A brilliant professor writes about the myths and Reality of the upcoming

2008 Stock Market Crash

Is a Collapse in the Cards?

Will the market crash continue in 2010? This is the trillion dollar question

By Jeremy Siegel on TradeOurMarkets.com

As I write this, stocks around the world are falling, the U.S. Federal Reserve is madly cutting interest rates to try to head off a recession, and everyone is worried about a global economic slowdown. Worries of a coming Stock Market Crash are all over the news. All this uncertainty was spawned by plunging U.S. home prices and the crash of the subprime debt market, which has blown up into an international credit crisis. What caused this fiasco, who is to blame and what it means for investors has been the subject of much debate. Here are the myths and realities:

Myth: The crisis resembles the one that hit the U.S. savings and loan industry two decades ago, necessitating a multibillion-dollar government bailout.

Reality: The current situation is very different from the savings and loan debacle of the 1980s. Back then, lenders used government-insured deposits to make risky investments with the full knowledge that if those investments failed, the government would have to make good on the depositors' balances. In the current crisis, the financial institutions are absorbing all the losses and no government bailout is planned.

Myth: The blame for the bubble in the housing market and pending Stock Market Crash rests with former U.S. Federal Reserve Chairman Alan Greenspan, who kept interest rates too low for too long.

Reality: While it certainly can be argued that Greenspan mismanaged short-term interest rates, that was not the major cause of the bubble. Soaring home prices were a worldwide phenomenon driven by demographics and low long-term interest rates, which were caused by low inflation and the huge buildup of savings in Asia. In fact many countries completely outside the dollar sphere, such as the U.K. and Spain, experienced an even greater real estate bubble than the U.S.

Myth: Because the current slowdown is due to the sharp cutback in the willingness of financial firms to lend, central banks can do little to improve the situation and stop the pending Stock Market Crash.

Reality: Central banks can and have done much to stabilize credit markets. The crisis was marked by a sharp increase in interest rates on bank lending over the targeted cost of funds set by central banks. Partly by injecting reserves into the market, central banks have ensured there is sufficient liquidity and reduced the "risk premium" attached to loans. The London Interbank Offered Rate (LIBOR), the peg for trillions of dollars of bank loans, has fallen from 5.75% last August to just over 3% today because of actions by the U.S. Federal Reserve. These declines have eased the anxiety in the credit markets. 2008 Stock Market Crash - Dow Jones, Nasdaq, S&P

Myth: Since almost all stock markets went up and down in unison during this crisis, international diversification is no longer an effective strategy for investors.

Reality: Although it is true that in the very short run stock markets have become increasingly correlated, there is no evidence that over longer time periods correlations between markets have increased. The speed of international communications means that traders instantly transmit both fear and euphoria across global markets, leading to similar day-to-day volatility. But longer-term movements depend on economic and profit trends within each country. Since more than half of the world's equity capital is now headquartered outside the U.S., maintaining a diversified international portfolio is as important as ever.

Myth: Most of the decline in the prices of financial stocks can be explained by the huge write-offs of mortgage-backed debt.

Reality: The decline in financial stocks far exceeds even the most bearish estimates of loan losses from mortgage-backed securities. From May 2007 to its recent low in January, financial stocks in the S&P 500 Index have declined by more than 35%, erasing more than $1 trillion in market capitalization. The market value of financial stocks headquartered outside the U.S. have also declined substantially. These losses far exceed the worst-case scenario of $200 billion in mortgage write-downs.

The only possible rationale for these huge price declines is that investors believe an economic downturn will significantly impair other assets of the banking industry and there will be a permanent decline in income from lending. The truth is that banks have greater access to central-bank liquidity now than before the crisis and will likely recapture some of the lending that has been lost over past years to the asset-backed commercial-paper markets.

Certainly over the past few years there was much foolish lending that had led to severe losses, and the economy will suffer in the short run. But actions by central banks will assure that this credit crisis does not morph into a full-blown recession or worse. And in the long run, saner lending and more reasonable home prices will lead to a stronger economic recovery.

Jeremy Siegel is the Russell E. Palmer professor of finance at the University of Pennsylvania's Wharton School

****2008 Stock Market Crash update*******

2/14 - Is the Stock Market looking for a Valentine's Day Massacre - Dow Down 186 points and falling fast. We will continue to update on the Bush Market Crash of 2008------

Not looking good for the US and International Stock Markets this morning (2/5/2008). The Fed prolonged our pain by slashing interest rates 2 weeks ago. Rather than "saving" the markets, they have extended the time it will take to get the stock markets to recovery mode. The Stock Market Crash of 2008 continues as the Dow opens down over 200 oints this morning, as the credit agencies continue to downgrade "investment grade" bonds.

Sorry for the Doom and Gloom, but the Fed has caused a coming market disaster. Rather than taking the excesses out of the markets, with a 700 point headline causing day. The Fed cut rates by 75 basis points, cutting today's market losses to only 140 points. Essentially this has spread the pain out over the next few months, rather than a 700 point painful day. We just got 1500 points of drawn out misery. You read it hear first.

We have not seen the bottom of the bear market in 2009, please don't be fooled by the bear market rally during this summer. The Crash of 2009 will continue in early September and will only get worse till mid 2010.

**************************

2008 STOCK MARKET CRASH

I would like to say this is a doomsday scenario out of a Science Fiction novel. I just hope you didn't sell your investment property and look to gain back the losses in the Stock Market. Unfortunately as I spend the evening watching markets around the world on the verge of collapse, I can only wonder where the S&P 500 and Dow will open on the morning of Tuesday, Jan. 22nd. Markets from Hong Kong to Japan to England and Germany are down an average of 9% between Monday, January 21st (while the US markets were closed) and Tuesday the 22nd. Curently the Dow Jones futures are down 530 points, while S&P 500 futures are down over 53 points. Thats around 6% and due to the holiday, Joe and Jane Public have no idea. They won't find out till they check the markets around 20 minutes after the open (delayed quotes on their iPhones).

Global stock markets extended their shakeout into a second day Tuesday, plunging amid worries that a possible U.S. recession will cause a worldwide economic slowdown.

The dramatic declines in Asia and Europe were expected to spread to Wall Street, where stock index futures were already down sharply hours before the trading day began. Japan's Nikkei 225 index, the benchmark for Asia's biggest bourse, was down 5.1 percent in afternoon trading after dropping 3.9 percent Monday.

Trading was halted in India when the Sensex index plummeted 9.75 percent within minutes of opening. Hong Kong's Hang Seng index dropped 8 percent by midday after diving 5.5 percent the day before.

"Unless we get some positive 'shock effects,' such as drastic measures from the U.S. government, there is almost no hope for a recovery in stocks," said Koji Takeuchi, senior economist at Mizuho Research Institute in Tokyo.

Asian markets have fallen sharply since the start of the year: Japan's benchmark index has sunk nearly 17 percent, while the Hang Seng is down a stunning 22 percent.

Oil and gold prices also fell. Light, sweet crude for February delivery fell to $88.35 a barrel amid speculation that slower U.S. growth will weaken demand. Spot gold, which usually benefits from market uncertainty, fell to a 2-week low of $860.90 per troy ounce.

U.S. markets were closed Monday for a holiday commemorating civil rights leader Martin Luther King Jr. But Wall Street future prices were down sharply, portending a plunge when trading begins at 9:30 a.m. Eastern time.

Dow Jones industrial average futures were down 486 points, or 4.1 percent, to 11,613, while Standard & Poor's 500 futures were down 62.7 points, or 4.7 percent, at 1,262.

Markets have been plunging amid pessimism about the ability of the U.S. government to prevent a recession. The Federal Reserve has indicated it will lower interest rates further, and President Bush has proposed an economic stimulus package that includes $145 billion in tax cuts, but investors around the world are doubtful that the measures will lift the economy quickly.

The American economy has been battered by a slump in the housing market and a credit crisis that has led to billions of dollars of losses among major U.S. banks.

There are already signs this is extending to less spending by American consumers, and that means less demand for Asian and European exports.

Symptomatic of an insoluble crisis of the world capitalist system

Stock prices plummeted worldwide Monday, amid heightened fears of a US recession. While over the course of last week US financial markets suffered the worst fall since 2002, with the Down Jones Industrial Average dropping by 5 percent, many Asian and European indices dropped by a similar amount in just one day.

It was the biggest one-day fall in world stock markets since September 11, 2001. Industrial stocks fell together with financial, suggesting that the US credit crisis, hitherto confined mainly to the banking and mortgage sectors, is spilling over into the real economy worldwide.

The huge fall in global equities markets indicate nothing if not the utter inadequacy of the fiscal stimulus package put forward by the Bush Administration last Friday.

The package, valued at some $145 billion dollars, or one percent of gross domestic product, will come mostly in the form of tax cuts to top income earners.

To put the measure in perspective, US household debt is now more than 100 percent of GDP, up from approximately 80 percent in 2003.

Given the current rate of debt accumulation among consumers, the stimulus package will put a tiny dent in overall debt accumulation by US households, and its effect on consumer spending and the foreclosure rate will be almost negligible.

The opinion pages of Monday’s Financial Times exemplify the thinking that led to the sell-off. In a column entitled “A fiscal stimulus offers limited help,” Clive Cook notes that the injection of cash from the US federal government will likely have little effect on consumer spending, partially due to the high debt accumulation among consumers.

Moreover, he writes, “confidence in the economy continues to plunge; on some estimates barely a third of the downward adjustment in house prices has happened; and the end of the credit crisis is not yet in sight.”

The column concludes, “Imminent fiscal stimulus notwithstanding, the heavy lifting on stabilising the US economy will therefore continue to be done by the Fed.”

Wolfgang Münchau, another Financial Times columnist, argues that rate cuts by the Federal Reserve are also likely to be limited in their effect on the real economy.

He writes, “There are recessions like the one in 2001, which respond well to a monetary policy stimulus. But not all do. This is going to be one of those.”

Perhaps most notable is the fact that Münchau refers a prospective downturn as “the 2008 recession,” taking for granted that one is imminent if not already in progress.

He continues: “Do not be fooled by anybody who says that the central bank should cut interest rates for the benefit of innocent citizens who have been caught up in this maelstrom.

"The first, second and third beneficiaries of the Federal Reserve’s pending helicopter drop of cash will be banks, not ordinary people or companies.”

While the columnists make strong cases against the effectiveness of either the proposed fiscal stimulus or Federal Reserve Board rate cuts, they do not put forward any convincing alternatives.

The overall sense is that the worldwide plunge of the stock markets is symptomatic of an insoluble crisis of the world capitalist system that has emerged with the bursting of the speculative subprime mortgage bubble in the US.

Threat of Recession Sends Markets Tumbling

Fears that 2008 will see the looming recession in the US spreading to every other continent triggered a global crash in share prices yesterday, wiping £77bn off the value of the City's blue-chip stocks in the biggest one-day points fall in London's history.

On a day of panic selling, hefty overnight falls on far eastern stock markets prompted a ripple effect through Europe and left the City's FTSE 100 index down 323.5 points at 5578.2 at the close.

Since the start of the year share prices have dropped by 14%, with the near 900-point fall in the FTSE 100 wiping out all the gains of the last 18 months and putting renewed pressure on pension funds.

Yesterday's 5.48% fall was the biggest in percentage terms since the immediate aftermath of the 9/11 terrorist attacks but less than half as big as the record 12.2% drop in October 1987.

In the City's money markets, traders were betting that the risk of a synchronised global downturn would force the Bank of England to cut interest rates by a full percentage point during the course of 2008 despite its concerns about inflationary pressure.

Economists are expecting the toughest year for the UK since the pound was removed from the Exchange Rate Mechanism in 1992.

In the US, pressure is mounting on the Federal Reserve to cut interest rates by 0.75 points at its meeting later this month, taking its main policy rate down to 3.5%.

Some analysts believe it will be necessary to cut rates to 1% by the end of this year to prevent the contagion from bad loans to subprime mortgage borrowers causing even more damage to the rest of the economy.

Shares in London closed near their lows for the day amid concerns that the market rout would continue today when Wall Street opens after being closed for the Martin Luther King public holiday.

Last night, there were indications that the Dow Jones industrial average would open more than 600 points lower.

In other markets, Japan's Nikkei index was down almost 4%, while Germany's Dax and France's CAC index both fell by 7%.

With markets in the developing world also suffering, the MSCI gauge of stock markets globally sank 3.3% percent, falling below its 2007 trough to lows last seen in December 2006 and taking it down more than 12% so far this year.

Dominique Strauss-Kahn, the managing director of the International Monetary Fund, warned western countries to expect knock-on effects from the slowdown in the US, the world's biggest economy.

"The situation is serious," Strauss-Kahn said after meeting the French president, Nicolas Sarkozy. "All countries in the world are suffering from the slowdown in growth in the United States, all countries in the developed world."

After briefly rising above $100 a barrel earlier this month, the cost of oil fell by $2 a barrel to $88.59 yesterday in expectation that weaker demand for energy would push down the price of crude.

Mining stocks were among the biggest losers in London amid concern that the boom in commodities seen in recent years would be ended by a global slowdown.

Nick Parsons, head of strategy for NAB Capital said: "There was no real trigger for what was a Black Monday. Overnight there was the very large sound of pennies dropping followed by a general market capitulation.

"What the markets have woken up to is that, yes, there will be a recession in the US and, no, the rest of the world won't be immune to that slowdown."

Graham Turner of GFC Economics said the gloomy mood in the markets might have been the delayed reaction to news last week of financial troubles for the US companies that insured the bonds linked to subprime mortgages, the value of which has plummeted as a result of falling real estate prices and rising home repossessions.

"The stock market has finally cracked and it has cracked because of all the underlying problems. People are worried about consumer spending going down, and with the stock market going down as well the two factors will start to feed off each other," said Turner.

It would be great if I could be in the "longterm investors hold tight camp", unfortunately it looks like cash and Gold may be the safest place for the next few years.

Home Online Business

Don't be fooled by the recent stock market rally (as of 8/4/09), this market will continue its decline. My belief is the stock market crash of 2009 will begin in Sept., the lows in the Dow and Nasdaq have not yet been seen. Look to Gold and Silver as the market crash of 2009 continues.